Why Housing Will Crash Again--But For Different Reasons Than Last Time

Institutionalizing the speculative excesses that inflated the previous housing bubble has fed magical thinking and fostered illusions of phantom wealth and security.

The global housing market has been dominated by magical thinking for the past 15 years. The magical thinking can be boiled down to this:

A person who buys a house for $50,000 will be able to sell the same house for $150,000 a few years later without adding any real-world value. The buyer will be able to sell the house for $300,000 a few years later without adding any real-world value. The buyer will be able to sell the house for $600,000 a few years later without adding any real-world value.

And so on, decade after decade and generation after generation: a house should magically accumulate enormous capital (home equity) without the owner having to do anything but pay the mortgage for a few years.

The capital isn't created by magic, of course: it's created by a greater fool paying a fortune for the house on the speculative confidence that an even greater fool will magically appear to pay an even greater fortune for the same house a few years hence.

This is the result of housing transmogrifying from shelter purchased to slowly build equity over a lifetime of labor into a speculative bet that credit bubbles will never pop. This transmogrification is the final stage of the larger dynamic of financialization, which turns every asset into a speculative commodity that can leveraged via debt and derivatives and sold into global markets.

The magic of something for nothing is especially compelling to a populace whose earnings have stagnated for decades. The housing bubble fed the fantasy that a household could set aside next to nothing for retirement and then cash out their "winnings" in the housing casino when they reached retirement age.

What believers in the sustainability of the housing casino conveniently ignore is the enormous risk (and debt) being taken on by the last greater fool: if the buyer pays cash, they are gambling on rents continuing to skyrocket along with home valuations, though these two are not as correlated as many assume.

Younger buyers have less disposable income than their elders due to deteriorating wages, higher student loan debt and higher taxes on earned income. As a result, the risk of their defaulting or being impoverished by the collapse of housing valuations is much higher than the risks faced by the buyers who rode the first bubble up to (ephemeral/phantom) riches.

The only way a young household can buy a $150,000 house for $600,000 is if interest rates are low enough to enable a modest income to leverage a huge mortgage. This is the basis of the Federal Reserve's campaign to buy Treasury bonds and mortgages: by driving interest rates to unprecedented lows, the Fed enables marginal buyers to become the last greater fool.

The first housing bubble circa 2001-2008 inflated as a result of financialization. The second, current echo-bubble has inflated on the socialization of financialization: the FHA and other government agencies have essentially taken over the entire mortgage market, guaranteeing or backing 95% of all mortgages, while the Fed has pushed rates down to historic lows to enable marginal buyers to make bets in the housing casino.

The current echo-bubble has another speculative source: cash buyers of homes to rent. About a third of all home sales in many markets are cash buyers, speculators hoping to cash in on the bubble by selling to a greater fool, or investors seeking the safe returns of rental housing.

Unbeknownst to the majority of these investors, there is no guaranteed return in rental housing when you overpay for the property and a recession guts demand for rentals. This is another form of magical thinking: nothing ever goes down.

The stock market goes higher forever, housing goes higher forever, and the Fed has banished recessions forever. If this isn't magical thinking, then what is it? Faith in the New Normal? Based on what?

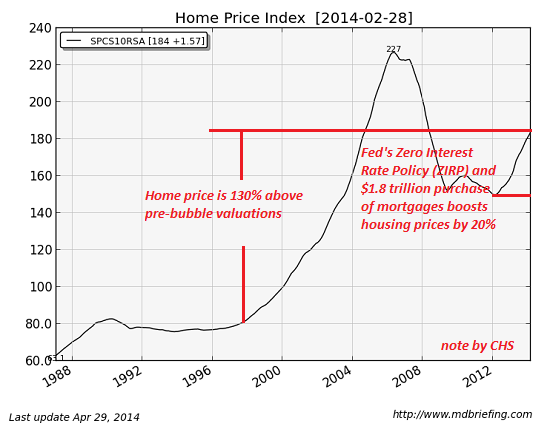

Let's quantify the magical thinking and the echo bubble with a few charts. Home prices are still 130% above pre-bubble valuations.

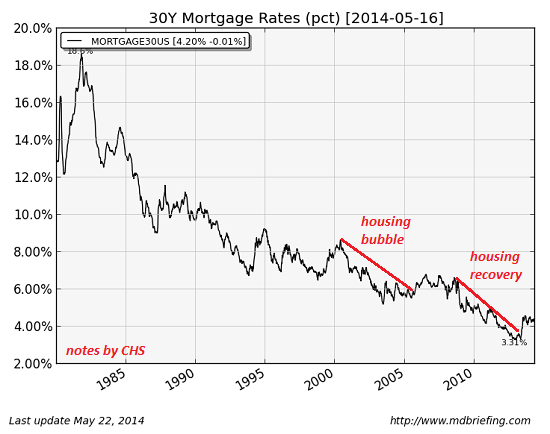

Declining mortgage rates (courtesy of the Fed) fueled the first housing bubble and the current echo-bubble.

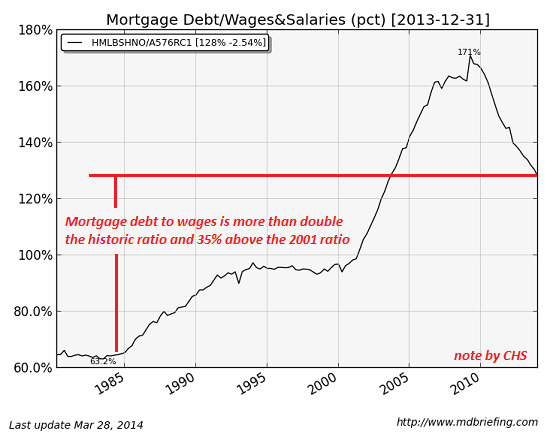

Measured by houshold earned income, mortgage debt is more than double the historic average of wages-to-mortgage-debt.

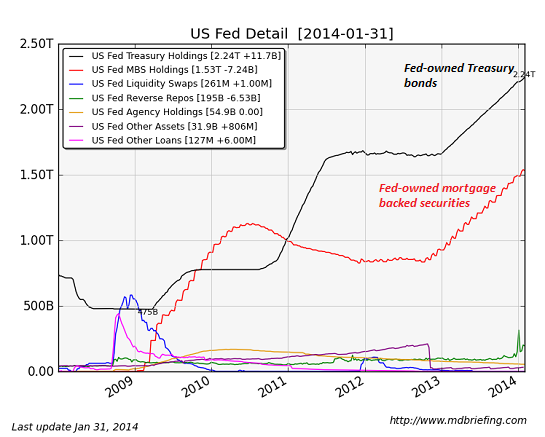

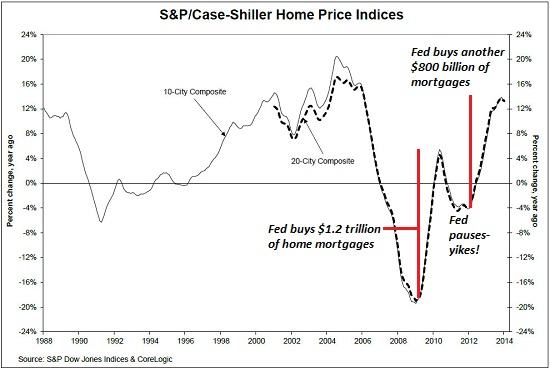

Take a look at the Fed's purchases of mortgages: from zero to $1.2 trillion, and then another $800 billion for good measure. The Fed has intervened in the Treasury market to the tune of almost $2 trillion to suppress interest rates.

The Fed's pause in mortgage purchases caused the housing market "recovery" to nosedive. This should make us wonder what will happen when the Fed's mortgage purchases finally end.

Relying on greater fools and expecting the rental housing market to magically ignore the ravages of recession for the first time in history is not a formula for financial or speculative success. The current echo-bubble in housing will pop, just like every other leverage/credit-fueled speculative bubble in history.

Institutionalizing the speculative excesses that inflated the previous housing bubble has fed magical thinking and fostered illusions of phantom wealth and security. The damage that will be unleashed by the echo-bubble deflating will be substantial, and in line with the The Smith Uncertainty Principle, not as predictable as many imagine:

The Smith Uncertainty Principle: Every sustained action has more than one consequence. Some consequences will appear positive for a time before revealing their destructive nature. Some consequences will be intended, some will not. Some will be foreseeable, some will not. Some will be controllable, some will not. Those that are unforeseen and uncontrollable will trigger waves of other unforeseen and uncontrollable consequences.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers (25 minutes, YouTube)

| Thank you, John S.P. ($50), for your magnificently generous contribution to this site -- I am greatly honored by your steadfast support and readership. | Thank you, Dogs Health ($5), for your much-appreciated generous contribution to this site -- I am greatly honored by your support and readership. |